Discover the Spain Digital Nomad Visa: eligibility, requirements, application process, costs, and benefits for remote workers. Live and work in Spain!

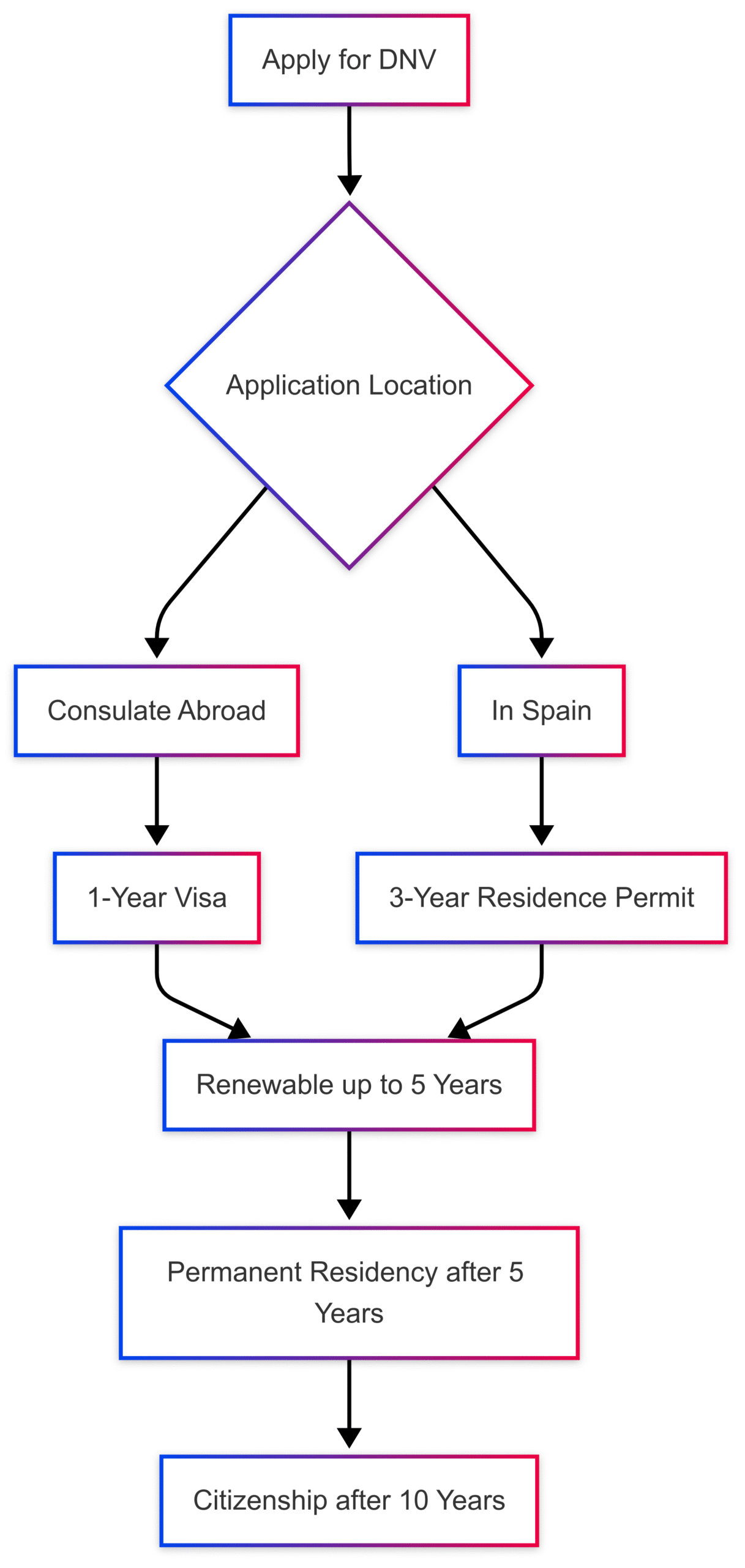

Spain’s Digital Nomad Visa (DNV), introduced in 2023 under the Startup Act, has transformed the country into a prime destination for remote workers and freelancers worldwide. This visa allows non-EU/EEA citizens to live and work in Spain for up to one year initially (or three years if applied for in-country), with the possibility of renewal for up to five years. With its affordable cost of living, vibrant culture, and favorable tax incentives, Spain is an attractive hub for digital nomads. This guide provides an in-depth look at the visa’s eligibility, requirements, application process, costs, tax implications, and the benefits of living in Spain as a digital nomad.

What is the Spain Digital Nomad Visa?

The Spain Digital Nomad Visa is designed for non-EU/EEA remote workers, freelancers, and self-employed individuals who work for companies or clients outside Spain using digital tools. Unlike traditional tourist visas, which limit stays to 90 days within a 180-day period, the DNV allows for longer-term residency and the opportunity to apply for a residence permit. This visa also permits freelancers to earn up to 20% of their income from Spanish clients, a unique feature compared to other countries’ digital nomad programs.

The visa aligns with Spain’s efforts to attract global talent and foster entrepreneurship. It offers a pathway to permanent residency after five years and, potentially, citizenship after ten years, depending on your nationality. The DNV also provides access to the Schengen Area, enabling visa holders to travel freely across 26 European countries.

Key Features of the Spain Digital Nomad Visa

| Feature | Details |

|---|---|

| Visa Duration | Up to 1 year (consulate application) or 3 years (in-country application) |

| Renewal | Renewable for up to 5 years, with 2-year increments |

| Eligibility | Non-EU/EEA citizens working remotely for non-Spanish employers or clients |

| Minimum Income | €2,763/month (single adult, 2025); additional for dependents |

| Tax Benefits | 19% tax rate on Spanish-sourced income up to €600,000 for 4 years |

| Schengen Access | Visa holders can travel freely within the Schengen Area |

Who Can Apply for the Spain Digital Nomad Visa?

The DNV is open to non-EU/EEA citizens, including those from the United States, Canada, Australia, New Zealand, and other countries. EU/EEA citizens do not require a visa to work remotely in Spain. Eligible applicants must meet specific criteria:

- Remote Work: Work for a company or client outside Spain using telecommunication systems. Freelancers can earn up to 20% of their income from Spanish clients.

- Qualifications: Hold a university degree, professional certificate, or have at least three years of relevant work experience.

- Employment Stability: Prove employment or freelance contracts active for at least three months prior to application.

- Company Validity: The employer or client’s company must have been operational for at least one year.

- Financial Means: Demonstrate a minimum monthly income of €2,763 (2025) for a single adult, with additional requirements for dependents.

- Clean Criminal Record: Provide a criminal record certificate from countries of residence in the past two years.

- Health Insurance: Hold private health insurance authorized in Spain, covering all risks of the public health system.

- Non-Residency: Not have resided in Spain for the past five years.

Family members, including spouses, unmarried partners, dependent children, and dependent ascendant relatives, can also apply for the visa, provided they meet additional documentation requirements.

Income Requirements for 2025

| Applicant Type | Minimum Monthly Income |

|---|---|

| Single Adult | €2,763 |

| Couple (Main + 1 Dependent) | €3,797 |

| Each Additional Adult | €1,035 |

| Each Minor Dependent | €346 |

Application Process for the Spain Digital Nomad Visa

The application process varies depending on whether you apply from abroad (via a Spanish consulate) or in Spain (via the Unidad de Grandes Empresas y Colectivos Estratégicos, or UGE). Below is a step-by-step guide to applying for the DNV.

Step 1: Gather Required Documents

Applicants must compile a comprehensive set of documents, many of which require legalization, apostille, or official Spanish translation. Key documents include:

- National Visa Application Form: Completed and signed by each applicant.

- Passport: Valid for at least one year with two blank pages.

- Photograph: Recent passport-size color photo with a light background.

- Criminal Record Certificate: Issued by countries of residence in the past two years, not older than six months, with an apostille.

- Proof of Residence: Evidence of legal residence in the consular district (e.g., utility bills or lease agreements).

- Health Insurance: Private health insurance authorized in Spain, covering all risks of the public health system.

- Proof of Employment:

- Employees: Certificate from the employer confirming at least three months of employment, contract length, salary, and explicit consent for remote work in Spain.

- Self-Employed: Contract terms allowing remote work in Spain and proof of client company operations for at least one year.

- Financial Proof: Documents (e.g., bank statements, payslips, contracts) proving the required income.

- Qualifications: University degree, professional certificate, or proof of three years of work experience (e.g., employment history or certificates of employment).

- Family Documents (if applicable): Birth or marriage certificates, proof of dependency for adult children or ascendant relatives, legalized or apostilled.

- Social Security Compliance:

- UK Applicants: A1 form (CA3822 for employees, CA3837 for self-employed) or proof of registration with Spanish Social Security (RETA for self-employed).

- Other Applicants: Declaration of compliance with social security obligations.

- NIE Number: Required prior to visa application (can be obtained at a Spanish consulate or in Spain).

All foreign documents must be legalized or apostilled and translated into Spanish by a sworn translator recognized by the Spanish Ministry of Foreign Affairs.

Step 2: Book an Appointment and Pay the Visa Fee

Applications must be submitted in person at a Spanish consulate or, for in-country applications, through the UGE. To book an appointment:

- Contact the consulate via email, providing your full name, passport details, contact information, and visa type.

- Expect an appointment within 2–4 weeks.

- Pay the visa fee (approximately €80, subject to currency fluctuations) via bank deposit, as instructed by the consulate.

For in-country applications, documents are submitted digitally to the UGE, often with the assistance of an immigration lawyer.

Step 3: Attend the Appointment

Bring all original documents and copies to the appointment. Be prepared to answer questions about your application. The consulate will retain your passport during processing and may request additional documents or an interview.

Step 4: Wait for Processing and Collect the Visa

- Processing Time: 15–45 business days, depending on the consulate or UGE workload.

- Tracking: Some consulates provide a tracking link to monitor application status.

- Collection: Approved visas must be collected in person or by a representative within one month. Denied applications are notified in writing, with a one-month window to appeal.

Step 5: Obtain NIE and TIE in Spain

Upon arrival in Spain, apply for a Número de Identidad de Extranjero (NIE) and, optionally, a Tarjeta de Identidad de Extranjero (TIE):

- NIE: Apply at a Foreigner’s Office or police station with your passport, visa, three passport photos, a completed application form, proof of address, and a €10–20 fee. Processing takes 1–3 months.

- TIE: Apply within two months of visa expiration if you plan to stay longer. Submit to the UGE or a local Foreigner’s Office.

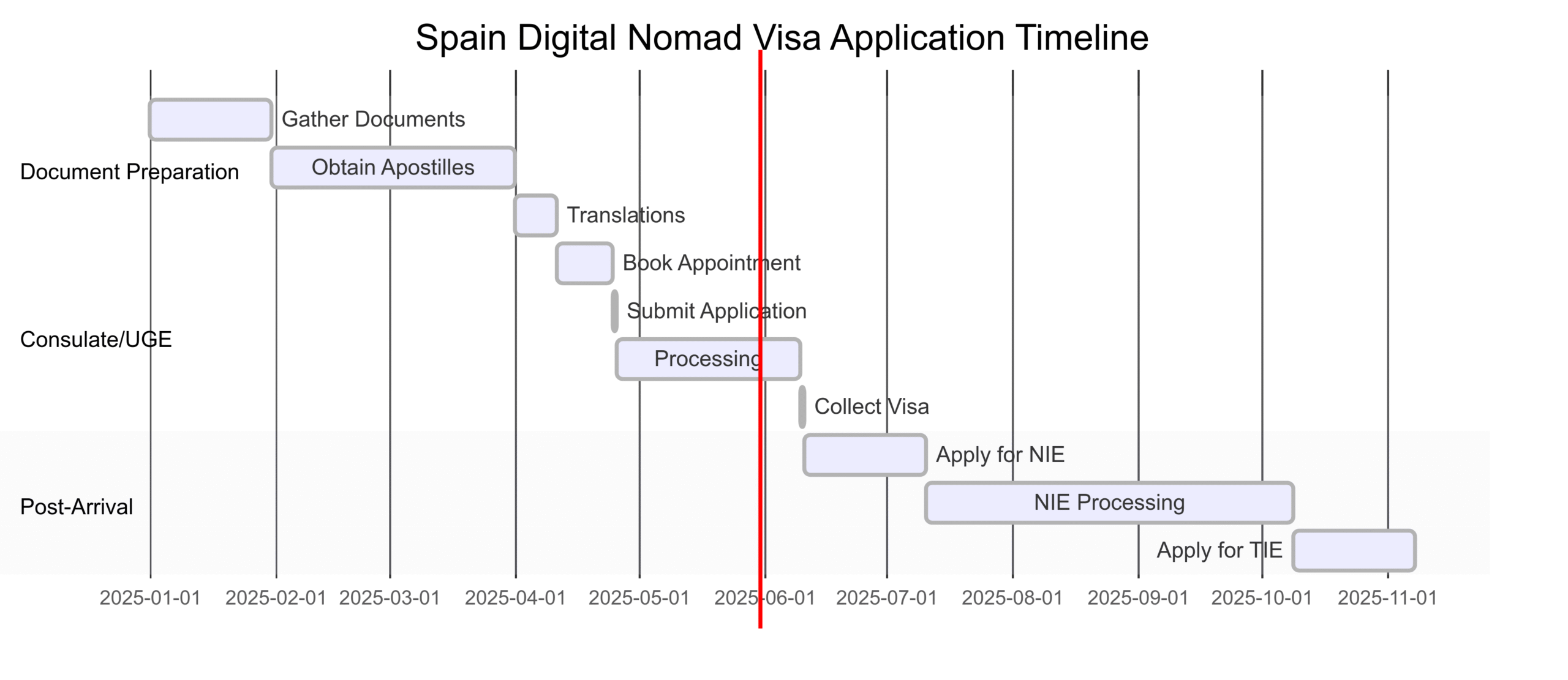

Application Timeline

Costs of Applying for the Spain Digital Nomad Visa

The cost of applying for the DNV varies by country due to document preparation fees. Below is a breakdown of typical expenses:

| Item | Cost (Approximate) |

|---|---|

| Criminal Record Check (US) | $18 |

| Criminal Record Check (UK) | £55 |

| Apostille (US) | $25–$75 per document |

| Apostille (UK) | £60+ per document |

| Spanish Translation | $20–$70 per document |

| Visa Application Fee | €80 |

| NIE/TIE Fee | €10–20 |

| Passport Photos | $10–$20 |

| Courier/Mailing Costs | $10–$50 |

Estimated Total: €200–€400, excluding travel costs or legal assistance.

For those hiring immigration lawyers (e.g., Lakbyte’s Standard Plus package at €1,250), costs may be comparable to DIY applications when factoring in translations and apostilles. Legal assistance can streamline the process and provide expertise on changing requirements.

Tax Implications for Digital Nomads in Spain

If you stay in Spain for more than 183 days per year, you become a tax resident, liable for taxes on worldwide income. However, the DNV offers tax benefits under the “Beckham Law”:

- Reduced Tax Rate: 19% on Spanish-sourced income up to €600,000 for the first four years.

- Standard Rates: Income above €600,000 is taxed at 47–48%.

- Double Taxation Treaties: Spain has agreements with over 90 countries to prevent double taxation. Consult a tax advisor to understand your obligations.

Freelancers registering as autónomos in Spain must pay social security contributions and income tax, which vary by region. A gestor (accountant) can assist with tax filings.

Benefits of Living in Spain as a Digital Nomad

Spain’s appeal as a digital nomad destination lies in its combination of affordability, culture, and infrastructure. Key benefits include:

- Affordable Cost of Living: Spain is 25% cheaper than France and 46% cheaper than the US. Average monthly costs for a single person in Barcelona are €1,500–€2,000, including rent.

- Excellent Weather: Sunny Mediterranean climate with mild winters and warm summers.

- Cultural Diversity: 17 autonomous regions offer varied landscapes, cuisines, and traditions, from Basque Country’s pintxos to Andalusia’s Moorish heritage.

- Digital Infrastructure: High-speed internet (average 200 Mbps) supports remote work.

- Schengen Access: Travel freely across 26 European countries.

- Vibrant Nomad Communities: Cities like Madrid, Barcelona, and Valencia host active digital nomad networks.

Cost of Living Comparison

| Amenity | Spain (Average) | Barcelona |

|---|---|---|

| Rent (1-Bedroom, City Center) | €750/month | €1,050/month |

| Rent (3-Bedroom, Outside Center) | €950/month | €1,300/month |

| Utilities | €130/month | €160/month |

| Wi-Fi | €35/month | €35/month |

| Public Transport (One-Way) | €1.45 | €2.40 |

| Lunchtime Meal | €12 | €14 |

| Evening Meal | €25 | €30 |

| Beer | €3 | €3.50 |

| Coffee | €1.75 | €2.15 |

| Groceries (2 People) | €200–€300/month | €300–€350/month |

Top Destinations for Digital Nomads in Spain

Spain’s diverse regions offer something for every digital nomad. Here are five top destinations:

- Madrid: The capital boasts cultural landmarks, museums, and vibrant coworking spaces.

- Barcelona: Combines beaches, modernist architecture, and a thriving nomad community.

- San Sebastian: Known for Michelin-star restaurants and scenic Bay of Biscay beaches.

- Balearic Islands: Offers Mediterranean beaches, hiking, and a party vibe in Ibiza and Mallorca.

- Seville: Features historic palaces, flamenco culture, and proximity to Andalusian beaches.

Challenges and Considerations

- Document Preparation: Obtaining apostilles and translations can take 2–3 months.

- Visa Denials: Common reasons include incomplete documents or insufficient income. Appeals must be filed within one month.

- Tax Complexity: Navigating Spanish tax residency and double taxation treaties requires professional advice.

- Housing: Securing long-term rentals in popular cities like Barcelona can be competitive.

FAQs About the Spain Digital Nomad Visa

Does Spain have a digital nomad visa?

Yes, introduced in 2023, it allows non-EU/EEA remote workers to live and work in Spain for up to five years.

Can I apply for the DNV while in Spain?

Yes, you can apply within 90 days of entering as a tourist, potentially securing a three-year residence permit.

What is the minimum income requirement?

€2,763/month for a single adult, with additional amounts for dependents.

Is the visa fee refundable?

No, the €80 fee is non-refundable, even if the application is denied.

Can I work for Spanish clients?

Freelancers can earn up to 20% of their income from Spanish clients.

Conclusion

The Spain Digital Nomad Visa offers a unique opportunity for remote workers to live in a culturally rich, affordable, and well-connected country. With a straightforward application process, favorable tax incentives, and access to the Schengen Area, it’s no surprise that Spain is a top destination for digital nomads. By carefully preparing documents and understanding tax obligations, applicants can navigate the process successfully, whether applying from abroad or in-country. Whether you’re drawn to Barcelona’s beaches, Madrid’s museums, or Seville’s historic charm, Spain provides an ideal backdrop for work and exploration.

Please share this Spain Digital Nomad Visa – Update with your friends and do a comment below about your feedback.

We will meet you on next article.

Until you can read, South Korea’s digital nomad visa