Discover the legality of being a digital nomad, visa options, tax obligations, and how to stay compliant while working remotely worldwide.

The digital nomad lifestyle—working remotely while traveling the world—has surged in popularity, with millions embracing the freedom to work from anywhere. But a lingering question remains: Is being a digital nomad legal? The short answer is yes, but the reality is layered with complexities involving visas, taxes, and local laws. This guide dives deep into the legal landscape of digital nomadism, offering practical insights, real-world examples, and actionable steps to ensure compliance while living this liberating lifestyle.

What Is a Digital Nomad?

A digital nomad is someone who leverages technology to work remotely while traveling or living in various locations. Typically, they are freelancers, entrepreneurs, or remote employees working for companies based in their home country or elsewhere. The allure lies in the flexibility to explore new cultures, landscapes, and communities without being tied to a single office or location.

While the concept sounds idyllic, the legal framework surrounding digital nomadism is less straightforward. Since “digital nomad” is not a legally recognized term in most jurisdictions, nomads must navigate a patchwork of immigration, tax, and labor laws to stay compliant.

The Legal Landscape of Digital Nomadism

Being a digital nomad is generally legal, but compliance hinges on understanding and adhering to the regulations of each country you visit or reside in. Below, we explore the three primary legal considerations: visas and immigration, tax obligations, and employment laws.

1. Visas and Immigration: Navigating Entry and Work Permissions

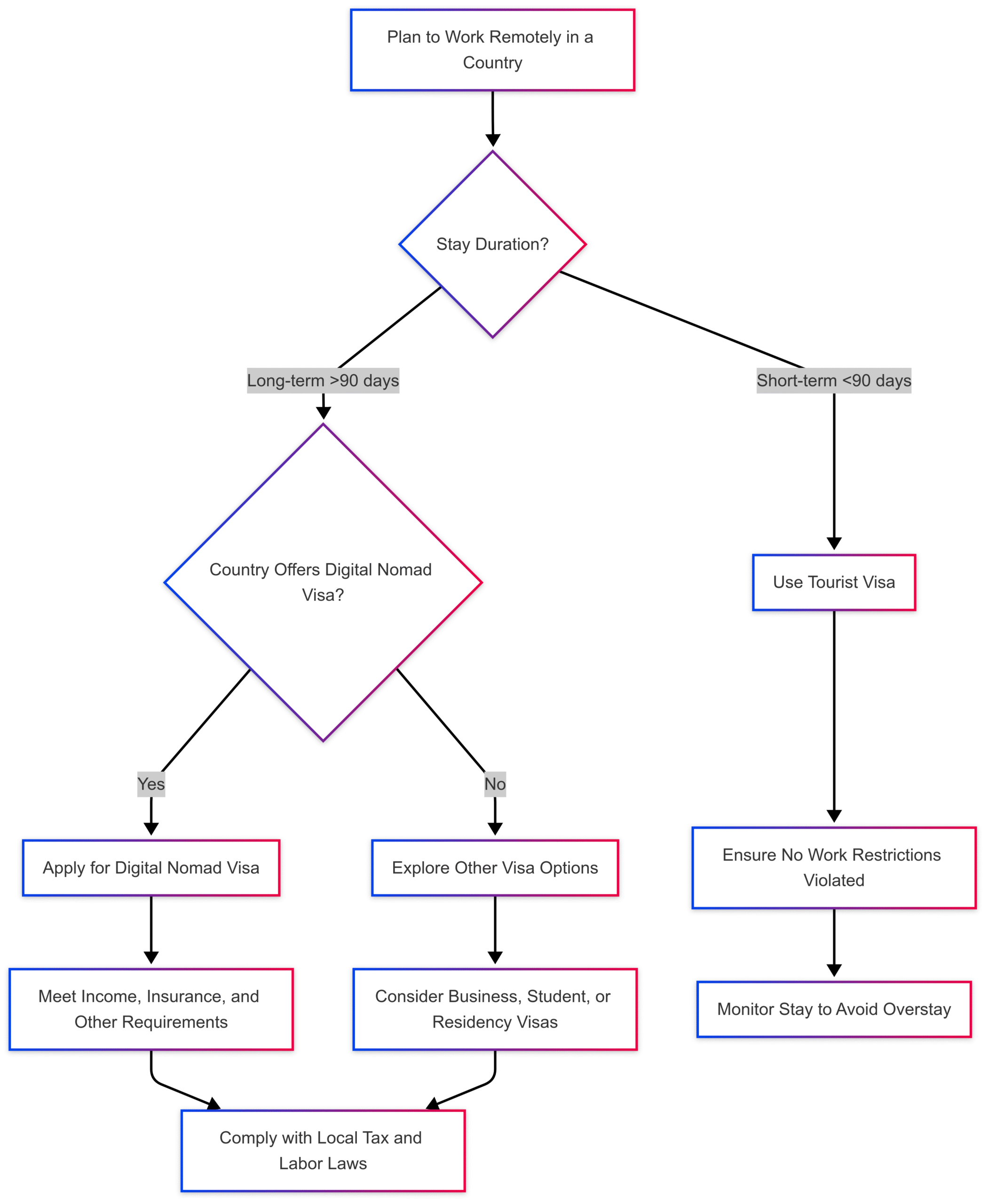

One of the most critical aspects of digital nomadism is understanding visa requirements. Most digital nomads rely on tourist visas for short stays, but these often come with restrictions on working. Here’s a breakdown of visa options and considerations:

Tourist Visas

Tourist visas allow entry for leisure or short-term stays, typically ranging from 30 to 90 days. However, most tourist visas explicitly prohibit working, creating a gray area for digital nomads. For example:

- United States: A B-2 tourist visa allows visitors to stay for up to six months but prohibits employment, including remote work for a foreign employer.

- Thailand: A tourist visa permits stays of 60 days (extendable by 30), but working without a permit is illegal, though enforcement is often lax unless attention is drawn.

Digital nomads often operate under the radar, working remotely on tourist visas without issues. However, this approach carries risks, as seen in the case of Kristen Gray, an American digital nomad deported from Bali for working on a tourist visa and promoting the island as a haven for remote work. Her high-profile social media posts drew scrutiny, leading to her deportation for violating immigration laws.

Digital Nomad Visas

To address the rise of remote work, many countries have introduced digital nomad visas, which explicitly allow remote work for foreign employers. These visas vary in duration, requirements, and benefits. Below is a table summarizing some popular digital nomad visa programs:

| Country | Visa Duration | Key Requirements | Cost (Approx.) | Tax Implications |

|---|---|---|---|---|

| Spain | 1 year (extendable to 5) | Proof of remote employment, min. income €2,160/month, health insurance | €75–€200 | Tax residency after 183 days |

| Portugal | 1 year (renewable) | Min. income €3,280/month, proof of remote work, accommodation proof | €75–€150 | Tax residency after 183 days |

| Estonia | Up to 1 year | Min. income €4,500/month, proof of remote work, valid health insurance | €100 | No tax residency if under 183 days |

| Croatia | Up to 1 year | Min. income €2,300/month, no local employment, clean criminal record | €60–€130 | Tax residency after 183 days |

| Japan | Up to 6 months | Min. income ¥10M (~$65,000/year), from select countries (e.g., US, Canada, UK) | ~$50 | No tax if under 183 days, but strict compliance |

Note: Costs and requirements are subject to change; always check official government sources before applying.

Visa Runs and Long-Term Stays

Some digital nomads use “visa runs,” leaving a country briefly to reset their tourist visa. However, countries like Thailand and Indonesia are increasingly cracking down on this practice, viewing it as an abuse of immigration laws. For longer stays, digital nomad visas or other long-term options (e.g., student or business visas) are safer alternatives.

Chart: Visa Decision Flowchart

Practical Tips for Visa Compliance

- Research Visa Rules: Check the embassy or official immigration website of your destination for up-to-date requirements.

- Avoid Declaring Work at Borders: Never mention “work” to immigration officers unless you have a work permit. Use terms like “business meetings” or “visiting.”

- Track Your Stay: Use apps or calendars to monitor visa expiration dates to avoid overstays.

- Consult Experts: Immigration consultants can help identify the best visa options for your travel plans.

2. Tax Obligations: Navigating Global Tax Systems

Taxation is one of the most complex aspects of digital nomadism. Misunderstandings can lead to unexpected liabilities or penalties. Here’s what you need to know:

Tax Residency

Most countries determine tax residency based on the “183-day rule,” where spending more than six months in a country may classify you as a tax resident, subjecting you to local income tax. For example:

- Bali, Indonesia: Requires taxes after 183 days, with rates up to 30% for non-residents.

- Czech Republic: Digital nomad visa holders pay a flat ~$80/month tax, regardless of income.

- United States: US citizens must file taxes on worldwide income, regardless of residency, but may claim the Foreign Earned Income Exclusion (up to $120,000 in 2023) if living abroad.

Locally Sourced Income

Many countries tax income generated within their borders, even for non-residents. This “locally sourced” rule means that if you’re physically in a country while earning income, you may owe taxes, regardless of where your employer or clients are based. For example:

- Thailand: Taxes income earned within the country, even for remote work, at progressive rates up to 35%.

- Canada: May tax non-residents for work performed in Canada, depending on the nature of the work.

However, enforcement is often lax in countries popular with digital nomads, as the administrative burden of tracking short-term visitors outweighs the revenue. Still, high-profile cases like Kristen Gray highlight the risks of assuming non-compliance is safe.

Home Country Taxes

Digital nomads must also comply with tax obligations in their home country. Some countries, like the UK, argue that nomads who don’t establish tax residency elsewhere remain liable for home country taxes, viewing their travels as an extended vacation. This has led to disputes, as nomads may assume they’re exempt due to prolonged absence.

Double Taxation Agreements

Many countries have treaties to prevent double taxation, allowing nomads to offset taxes paid in one country against liabilities in another. For instance, the US has treaties with over 60 countries, reducing the risk of paying taxes twice on the same income.

Table: Tax Considerations for Digital Nomads

| Aspect | Details |

|---|---|

| Tax Residency | 183 days in a country may trigger residency and local tax obligations. |

| Locally Sourced Income | Income earned while in a country may be taxable, even on tourist visas. |

| Home Country Taxes | Nomads may owe taxes in their home country unless they establish residency elsewhere. |

| Double Taxation | Treaties can reduce tax burdens; check agreements between home and host countries. |

| Professional Advice | Tax accountants specializing in expat or nomad taxes can ensure compliance. |

Practical Tips for Tax Compliance

- Track Your Days: Use a spreadsheet or app to log days spent in each country to avoid triggering tax residency.

- Hire a Tax Professional: Work with accountants familiar with digital nomad tax issues to navigate complex rules.

- Understand Treaties: Research double taxation agreements to minimize liabilities.

- Keep Records: Maintain detailed records of income, clients, and work locations for tax reporting.

3. Employment Laws: Remote Work and Local Regulations

While digital nomads typically work for foreign employers or as freelancers, local labor laws can still apply. For example:

- Work Permits: In most countries, working without a permit—even remotely—technically violates immigration law. Digital nomad visas address this by explicitly allowing remote work.

- Data Governance: Working with proprietary data in certain countries may violate data protection laws. For instance, taking an employer’s laptop to a country with strict data regulations could trigger compliance issues.

- Employer Liabilities: If employed, your remote work could create tax or legal obligations for your employer in the host country, especially if you stay long-term.

Enforcement of these laws is rare for short-term nomads, but prolonged stays or public attention can lead to scrutiny. For example, a company employing a nomad in Thailand without registering a local presence could face penalties.

Practical Tips for Employment Compliance

- Use Digital Nomad Visas: These visas clarify your right to work remotely, reducing legal risks.

- Inform Your Employer: If employed, discuss your travel plans to ensure compliance with their policies and local laws.

- Avoid Sensitive Data: Be cautious about working with proprietary or sensitive data in countries with strict regulations.

Real-World Examples: Lessons from the Field

The case of Kristen Gray in Bali serves as a cautionary tale. Gray, an American digital nomad, was deported after posting on social media about Bali’s affordability and queer-friendly environment, which authorities deemed as promoting tourism during COVID-19 restrictions. She was accused of working without a business visa and spreading “unsettling” information. Her case underscores the importance of:

- Keeping a low profile to avoid drawing attention from authorities.

- Understanding that even remote work on a tourist visa can be deemed illegal.

- Researching local cultural and legal sensitivities before publicizing your presence.

Other examples highlight enforcement trends:

- Thailand: In recent years, Thailand has cracked down on foreigners working without permits, especially those flaunting their activities online.

- Indonesia: Beyond Gray’s case, Indonesia has deported foreigners for violating health protocols or working illegally, signaling stricter oversight.

Pros and Cons of the Digital Nomad Lifestyle

To provide a balanced perspective, here are the key advantages and challenges of digital nomadism:

Pros:

- Freedom to Travel: Work from anywhere—beaches, cafes, or coworking spaces—without waiting for vacation time.

- Cultural Immersion: Experience diverse cultures and build a global network.

- Cost Savings: Live in countries with lower costs of living, stretching your income further.

- Flexible Work: Eliminate commutes and design your workday around your lifestyle.

Cons:

- Legal Complexities: Navigating visas, taxes, and labor laws requires diligence.

- Social Challenges: Constant travel can lead to loneliness or difficulty forming deep connections.

- Internet Dependency: Reliable Wi-Fi becomes a top priority, limiting destination choices.

- Administrative Burden: Researching and complying with regulations can be time-consuming.

Staying Legal as a Digital Nomad

To thrive as a digital nomad while staying compliant, follow these actionable steps:

- Research Visa Options: Before traveling, check visa requirements and prioritize digital nomad visas where available. Websites like Nomad List or official government portals provide reliable information.

- Understand Tax Obligations: Track your days in each country and consult a tax professional to ensure compliance with home and host country laws.

- Keep a Low Profile: Avoid publicizing your work or lifestyle in ways that could attract scrutiny, as seen in the Kristen Gray case.

- Use Professional Services: Immigration and tax advisors specializing in digital nomadism can save time and prevent costly mistakes.

- Leverage Technology: Tools like TaxResidency or Nomad Capitalist offer resources for managing tax and visa compliance.

- Stay Informed: Laws change frequently, especially as digital nomadism grows. Subscribe to newsletters or join communities like r/digitalnomad on Reddit for updates.

The Rise of Digital Nomadism

The digital nomad population is booming, with over 4.8 million Americans alone identifying as nomads, according to industry estimates. The rise of remote work, accelerated by the pandemic, has fueled this trend. Companies now offer fully remote roles, and entrepreneurship opportunities—such as freelancing platforms like Upwork or Fiverr—enable nomads to build sustainable incomes.

Countries are responding by creating digital nomad visas to attract remote workers, who contribute to local economies without competing for local jobs. For example, Spain’s digital nomad visa has drawn thousands of applicants, boosting tourism and local spending.

Starting Your Digital Nomad Journey

If the digital nomad lifestyle appeals to you, here’s how to begin:

- Secure a Remote Income: Explore remote jobs on platforms like We Work Remotely or start a freelance business in fields like writing, design, or programming.

- Choose Destinations Wisely: Prioritize countries with digital nomad visas or lenient tourist visa policies, such as Portugal, Thailand, or Mexico.

- Build a Support Network: Join communities like Nomads Embassy or Digital Nomad World for guidance and support.

- Invest in Tools: Ensure you have a reliable laptop, global SIM card, and travel insurance tailored for nomads (e.g., SafetyWing or World Nomads).

Conclusion

Being a digital nomad is legal, but it requires careful navigation of visas, taxes, and employment laws. By researching regulations, leveraging digital nomad visas, and consulting professionals, you can enjoy the freedom of this lifestyle without legal pitfalls. Whether you’re dreaming of working from a Balinese beach or a Lisbon café, the key is preparation and compliance. Start your journey informed, stay discreet, and embrace the world as your office.

Please share this How to Become a Digital Nomad: Pros, Cons, and Jobs with your friends and do a comment below about your feedback.

We will meet you on next article.

Until you can read, How to Become a Digital Nomad: Pros, Cons, and Jobs