Explore the digital nomad visa vs. tourist visa dilemma. Learn benefits, requirements, risks, and why countries are embracing remote workers.

The rise of remote work has transformed how people live and work globally, giving birth to a new breed of professionals: digital nomads. These location-independent workers, armed with laptops and reliable internet, travel the world while earning a living. However, a critical question looms for these modern wanderers: should they opt for a digital nomad visa or rely on traditional tourist visas? This dilemma sits at the intersection of legal compliance, personal freedom, and economic opportunity. In this article, we’ll dive deep into the nuances of digital nomad visas, compare them with tourist visas, explore their implications for nomads and employers, and assess whether these new visa programs are worth the hype.

Understanding the Digital Nomad Lifestyle

Digital nomads are remote workers who leverage technology to perform their jobs from anywhere in the world. The term, first coined in 1997 by Tsugio Makimoto and David Manners in their book Digital Nomad, envisioned a future where technology would untether workers from fixed offices. Fast-forward to today, and the lifestyle has exploded. An estimated 40 million digital nomads contribute $787 billion annually to the global economy, with one in ten U.S. workers now embracing this lifestyle. The COVID-19 pandemic accelerated this trend, as prolonged work-from-home policies and the “Great Resignation” pushed millions to seek flexibility and adventure.

Digital nomads range from freelancers and entrepreneurs to employees of global companies. They typically stay in a country for a few months to a year, blending work with cultural exploration. This mobility, however, raises legal questions about visa compliance, as traditional tourist visas often prohibit work. Enter the digital nomad visa—a tailored solution designed to address this gray area.

What Are Digital Nomad Visas?

Digital nomad visas are specialized immigration programs that allow remote workers to live and work legally in a foreign country for an extended period, typically six months to a year, though some, like Thailand’s, extend up to five years. Unlike tourist visas, which are intended for leisure, digital nomad visas explicitly permit remote work for foreign employers or self-employment, provided certain conditions are met.

Requirements for Digital Nomad Visas

While requirements vary by country, most digital nomad visas share common criteria:

- Proof of Remote Employment or Self-Employment: Applicants must demonstrate they work for a company or clients outside the host country or run their own business.

- Minimum Income Threshold: Many countries set a minimum income requirement, often ranging from $2,000 to $4,000 per month, to ensure nomads can support themselves without burdening local economies.

- Valid Health Insurance: Coverage for the duration of the stay is typically mandatory.

- Clean Criminal Record: A background check is often required to ensure compliance with local laws.

- Fixed Address: Some countries, like Portugal, may require proof of accommodation before granting the visa.

- Tax Compliance: Applicants may need to provide a tax status certificate or proof of tax residency in their home country.

Benefits of Digital Nomad Visas

Digital nomad visas offer several advantages over tourist visas:

- Legal Work Authorization: They eliminate the risk of violating immigration laws by explicitly allowing remote work.

- Extended Stay: Most digital nomad visas permit stays of six months to a year, far longer than the typical 90-day tourist visa.

- Economic Contribution: Nomads spend on accommodation, dining, and local services, boosting host economies.

- Cultural Integration: Longer stays allow nomads to immerse themselves in local cultures without the pressure of short-term visa limits.

Countries Offering Digital Nomad Visas

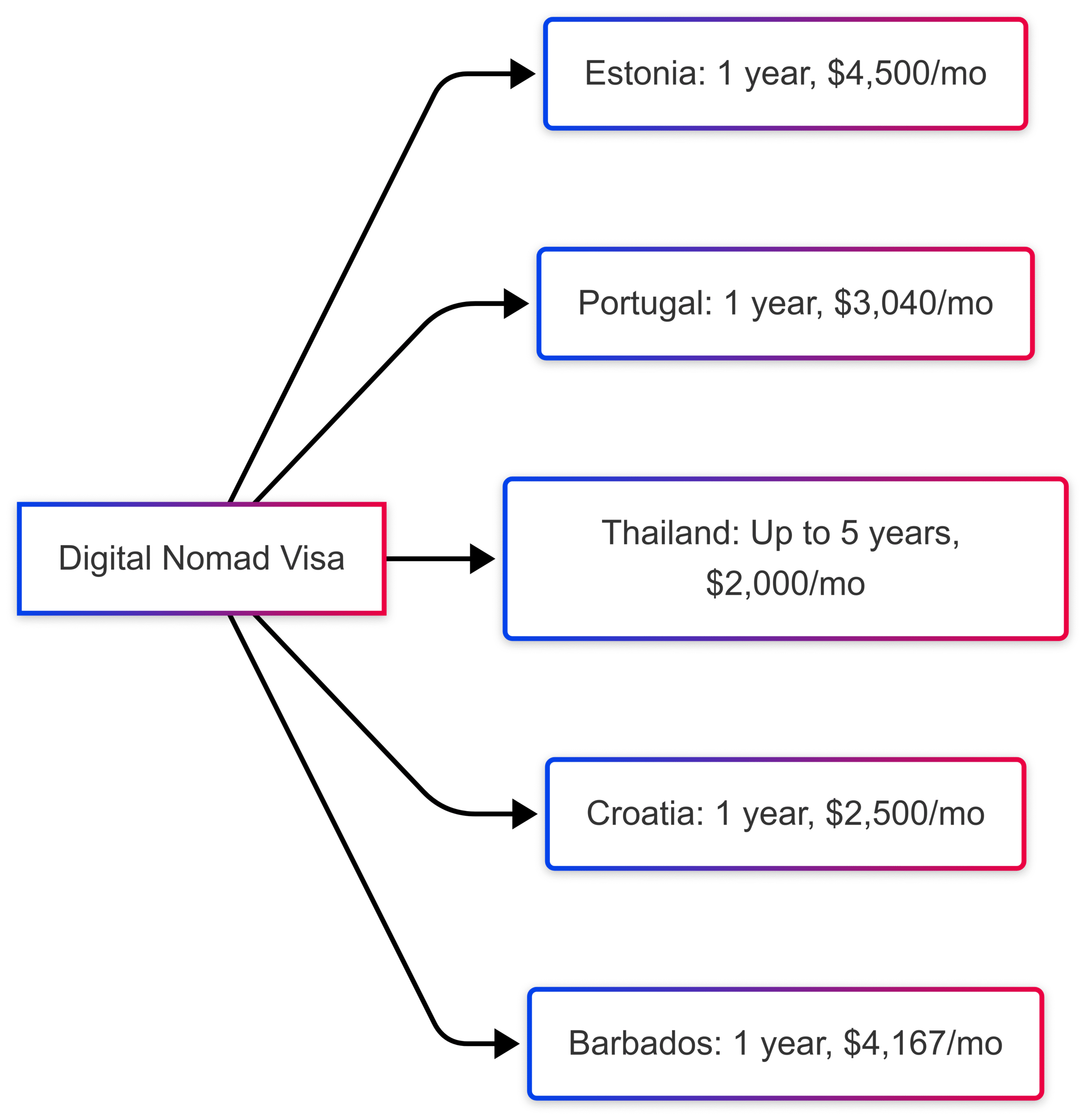

Over 60 countries have introduced digital nomad visas since Estonia pioneered the concept in 2020. Here’s a snapshot of some popular programs:

| Country | Visa Duration | Minimum Income (Monthly) | Application Fee | Key Requirements |

|---|---|---|---|---|

| Estonia | 1 year | $4,500 | $100 | Proof of employment, health insurance, criminal record check |

| Portugal | 1 year | $3,040 | $85 | Proof of accommodation, income verification, tax certificate |

| Thailand | Up to 5 years | $2,000 | $300 | Health insurance, proof of remote work |

| Croatia | 1 year | $2,500 | $130 | Criminal record check, proof of income |

| Barbados | 1 year | $4,167 ($50,000/year) | $2,000 (individual) | Health insurance, income verification |

The Tourist Visa Alternative

Tourist visas, designed for leisure travel, are the default choice for many digital nomads due to their simplicity and accessibility. Most countries allow visa-free or visa-on-arrival entry for short stays (30–90 days) for citizens of certain nations, such as U.S., U.K., or EU passport holders. However, tourist visas come with significant limitations and risks.

Limitations of Tourist Visas

- Short Duration: Most tourist visas allow stays of 30–90 days, insufficient for nomads seeking longer-term immersion.

- Work Restrictions: Tourist visas typically prohibit any form of work, including remote work for foreign employers.

- Visa Runs: Some nomads extend their stays by leaving and re-entering a country to reset the visa clock, a practice that can raise red flags with immigration authorities.

Risks of Working on a Tourist Visa

Working remotely on a tourist visa is a legal gray area. While the risk of detection is low—border officials rarely monitor laptop activity—consequences can be severe if caught:

- Fines and Deportation: Violating visa terms can result in hefty fines or immediate deportation.

- Criminal Liability: In extreme cases, unauthorized work may lead to legal action, though this is rare.

- Future Entry Bans: Non-compliance can jeopardize future travel to the same country.

Historically, many digital nomads operated under the radar, relying on the leniency of immigration authorities. Pre-COVID, governments often overlooked short-term remote work, especially since nomads contributed to local economies without competing for local jobs. However, as nomad numbers grow, scrutiny is increasing.

The COVID-19 Catalyst

The COVID-19 pandemic was a turning point for remote work and digital nomadism. Lockdowns forced millions to work from home, normalizing remote work and sparking the “Work from Anywhere” movement. As employees grew accustomed to location flexibility, many rejected the return to traditional offices, fueling the Great Resignation. This shift prompted governments to rethink immigration policies to capture the economic potential of digital nomads.

Economic Impact of Digital Nomads

Digital nomads are a boon for host economies. For example, Madeira, Portugal, sustained its economy during COVID by attracting nomads with open borders and extended visas. Nomads spend heavily on accommodation, dining, and local experiences, often outpacing traditional tourists. In Lisbon, however, this influx has driven up rental prices, with apartments that once cost €550 per month now fetching €1,500, sparking local resentment.

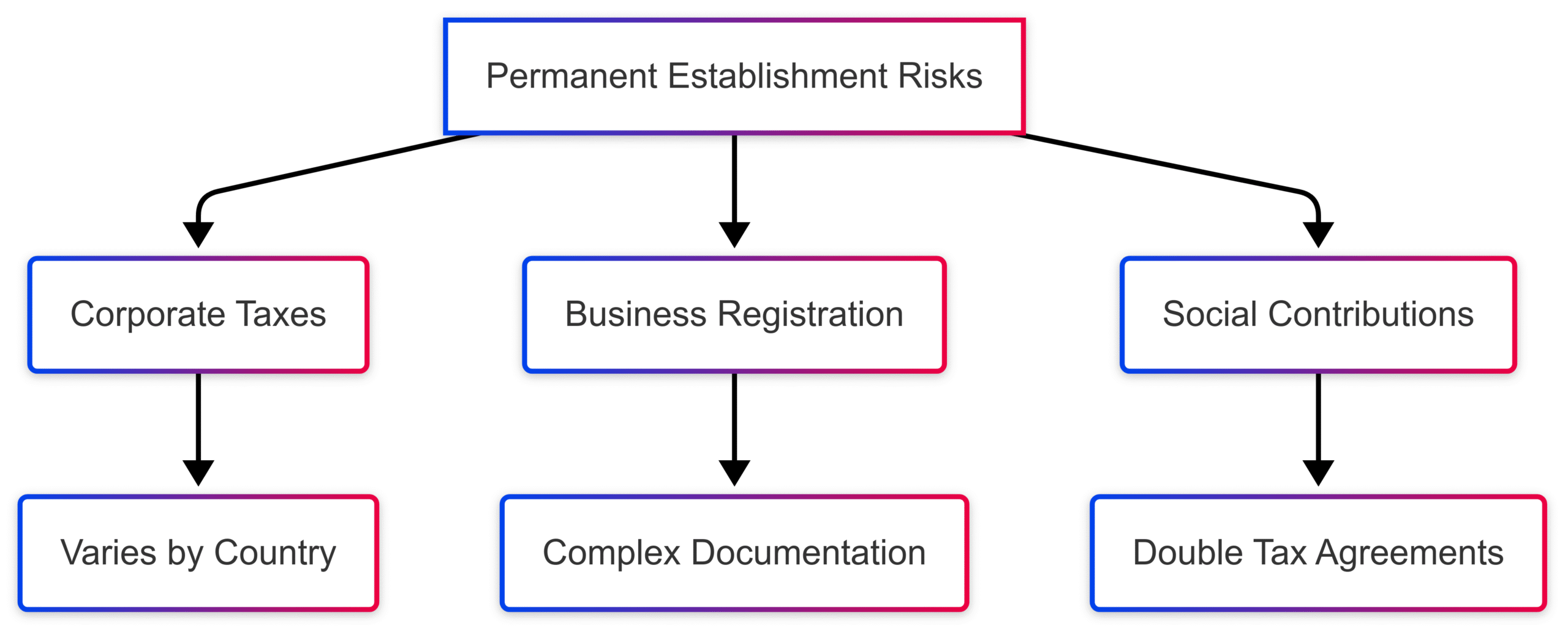

The Permanent Establishment Trap

For employers, the digital nomad lifestyle poses a significant risk: the Permanent Establishment (PE) trap. If an employee works remotely from a foreign country for an extended period, the host country may deem the employer to have established a taxable presence, triggering obligations such as:

- Corporate Taxes: The employer may need to pay taxes in the host country.

- Business Registration: Formal registration as a business entity may be required.

- Social Contributions: Contributions to local social security or health systems may apply.

PE rules vary by country, but they often hinge on the duration and nature of the employee’s work. For example, working from a co-working space rather than a home office may increase the likelihood of triggering a PE. Double Tax Agreements (DTAs) between countries can mitigate these risks, but compliance remains complex. For instance, Australia requires minimal payroll reporting, while France demands extensive documentation, creating administrative headaches for employers.

Digital Nomads vs. Digital Expats

The terms “digital nomad” and “digital expat” are often used interchangeably, but they represent distinct lifestyles:

- Digital Nomads: Constantly on the move, staying in a country for a few months before relocating. They prioritize flexibility and exploration, often relying on tourist or bilateral visas.

- Digital Expats: Settle in one country for six months to a year, seeking a more stable, semi-permanent experience. They are more likely to pursue digital nomad visas for legal security.

Digital expats are the primary target for most digital nomad visa programs, as their longer stays align with visa durations and economic goals. For example, a U.S. employee taking a year-long “sabbatical” in Barbados may find the digital nomad visa ideal, while a true nomad hopping between countries may prefer the simplicity of tourist visas.

Why Digital Nomad Visas Haven’t Taken Off

Despite their promise, digital nomad visas have seen surprisingly low uptake. Nomads Embassy reports that only 9,277 visas have been issued across popular destinations like Croatia, Cyprus, and Portugal, with Thailand approving around 1,200. Compared to the 40 million digital nomads worldwide, this suggests a mere 10,000–15,000 visas have been granted globally.

Barriers to Adoption

Several factors explain the lackluster response:

- Bureaucratic Hassles: Visa applications often require extensive documentation, such as payslips, tax certificates, and proof of accommodation, deterring nomads accustomed to visa-free travel.

- High Costs: Application fees, ranging from $85 (Portugal) to $2,000 (Barbados), can be prohibitive, especially for short-term stays.

- Restrictive Requirements: Some countries impose minimum stay requirements or demand applications from the nomad’s home country, limiting flexibility.

- Low Risk of Detection: Many nomads work discreetly on tourist visas, facing minimal risk of enforcement. Border officials rarely scrutinize remote work activities.

- Bilateral Visas: Bilateral agreements, such as those allowing U.S. citizens to stay in Albania for a year without a visa, offer simpler alternatives.

The Role of Bilateral Visas

Bilateral visas, often established post-World War II, allow extended stays or work rights between specific countries. For example, some Caribbean nations accept U.S. visas in lieu of their own, while certain European bilateral agreements supersede Schengen rules. These visas, with their broader scope and lower barriers, often outshine digital nomad visas for true nomads.

Risks for Employers and Employees

For digital nomads, working on a tourist visa carries risks beyond deportation. Employers face even greater exposure:

- Contract Breaches: Government contracts may require data to remain within the employer’s home country, making remote work abroad a violation.

- Labor Law Violations: Nomads may inadvertently become subject to local labor laws, such as restrictions on working hours in some European countries.

- Data Security: Remote work from unsecured networks or co-working spaces can expose sensitive company data.

- Team Dynamics: Time zone differences and remote work can strain team cohesion, particularly for senior employees whose presence may signal a PE.

As border technologies, like the EU’s EES/ETIAS system, improve tracking of travelers’ activities, the risks of non-compliance will grow. Employers must implement clear policies and monitoring tools to ensure compliance with visa and tax regulations.

The Future of Digital Nomad Visas

Digital nomad visas are still in their infancy, and their success depends on governments addressing current shortcomings. Countries like Thailand, with its five-year visa, are experimenting with longer durations to attract nomads. Others may need to reduce bureaucratic barriers or lower fees to compete in an increasingly crowded market.

True digital nomads, who prioritize mobility, are unlikely to embrace visas that require lengthy applications or fixed residences. Digital expats, however, may find these visas appealing for longer, more stable stays. As competition grows, countries may refine their programs to balance economic benefits with local concerns, such as housing affordability.

Potential Improvements

- Streamlined Applications: Online portals and simplified documentation could boost uptake.

- Lower Costs: Reducing fees to align with tourist visa costs would make digital nomad visas more attractive.

- Flexible Terms: Allowing shorter stays or remote applications would cater to true nomads.

- Clear Tax Guidelines: Transparent rules on taxation and PE risks would reassure employers and nomads alike.

Making the Choice: Digital Nomad Visa or Tourist Visa?

The decision to pursue a digital nomad visa or stick with a tourist visa depends on several factors:

- Duration of Stay: For stays under 90 days, tourist visas are often sufficient. For longer stays, digital nomad visas provide legal security.

- Employer Requirements: Some employers may mandate a digital nomad visa to mitigate PE risks.

- Destination: Countries with restrictive immigration policies or high visa costs may push nomads toward tourist visas or bilateral agreements.

- Lifestyle Goals: Nomads seeking flexibility may prefer tourist visas, while expats aiming for stability may opt for digital nomad visas.

Key Considerations

- Cost vs. Benefit: Weigh the visa application cost against the risk of non-compliance.

- Internet Reliability: Ensure the destination has robust internet infrastructure for remote work.

- Tax Implications: Research double tax agreements to avoid unexpected liabilities.

- Cultural Fit: Choose destinations that align with your lifestyle and work needs.

Conclusion

The digital nomad visa dilemma reflects a broader tension between freedom and compliance in the age of remote work. Digital nomad visas offer a legal pathway for remote workers to live and work abroad, but their bureaucratic hurdles and costs deter many true nomads. Tourist visas, while simpler, carry legal risks that could impact both nomads and their employers. As governments refine these programs and border technologies evolve, the balance may shift toward greater adoption of digital nomad visas, particularly for digital expats seeking longer stays.

For now, the choice depends on your goals, resources, and risk tolerance. Whether you’re a nomad chasing adventure or an expat seeking a temporary home, understanding the legal and economic implications of your visa choice is crucial. As the digital nomad movement continues to grow, so too will the opportunities—and challenges—of living and working anywhere.

Please share this The Digital Nomad Visa Dilemma – To Visa or Not to Visa with your friends and do a comment below about your feedback.

We will meet you on next article.

Until you can read, Goa, India for Digital Nomads: The Ultimate Guide