Discover the key differences between Digital Nomad Visa and Tourist Visa: purpose, duration, work legality, costs, and more for remote workers and travelers.

The rise of remote work has reshaped how people travel and live abroad. For those embracing the freedom to work from anywhere, choosing the right visa is critical. Two primary options exist: the Digital Nomad Visa and the Tourist Visa. While both allow stays in foreign countries, they serve vastly different purposes, with distinct rules, durations, and implications for remote workers. This comprehensive guide explores the key differences, helping you decide which visa aligns with your travel and work goals.

Understanding the Basics

What is a Tourist Visa?

A Tourist Visa is designed for short-term visits focused on leisure, sightseeing, or personal travel. It’s typically easy to obtain, often requiring minimal documentation, and is ideal for vacationers or short-term explorers. However, it comes with strict limitations, particularly around work.

- Purpose: Leisure, tourism, or visiting friends and family.

- Duration: Typically 30–90 days, depending on the country.

- Work Restrictions: Prohibits any form of work, including remote work for foreign employers.

- Cost: Often free or low-cost (e.g., $20–$100).

- Application Process: Simple, requiring a valid passport, proof of funds, and sometimes a return ticket.

- Family Inclusion: Generally does not allow spouses or children to join.

Tourist visas are perfect for short, non-work-related trips but offer little flexibility for those looking to stay longer or work remotely.

What is a Digital Nomad Visa?

A Digital Nomad Visa is a relatively new visa category tailored for remote workers, freelancers, and online entrepreneurs who earn income from outside the host country. These visas allow longer stays and explicitly permit remote work, making them ideal for location-independent professionals.

- Purpose: Facilitate remote work and extended stays.

- Duration: Ranges from 6 months to 2 years, often renewable.

- Work Permissions: Allows remote work for foreign employers or clients.

- Cost: Varies widely, from free to $2,000, depending on the country.

- Application Process: Requires proof of income, remote work status, health insurance, and sometimes a background check.

- Family Inclusion: Often allows spouses and children to join, subject to specific conditions.

Digital nomad visas provide legal clarity and access to local services, making them a game-changer for remote workers seeking stability abroad.

Key Differences at a Glance

To better understand the distinctions, here’s a comparison of the two visa types:

| Feature | Digital Nomad Visa | Tourist Visa |

|---|---|---|

| Purpose | Remote work, extended stay | Short-term travel, leisure |

| Duration | 6–24 months, often renewable | 30–90 days, limited extensions |

| Work | Permitted (remote, for foreign employers) | Not permitted |

| Taxation | May involve local taxes | Typically no tax obligations |

| Cost | $200–$2,000 (varies by country) | Free or low-cost ($20–$100) |

| Family Inclusion | Often allows spouses/children | Typically does not allow family |

| Intended Residency | Temporary residence | Temporary visit, no residency |

This table highlights the core distinctions, but let’s dive deeper into each aspect to understand their practical implications.

Detailed Comparison

1. Purpose and Intent

The primary difference lies in the purpose of each visa. A Tourist Visa is for travelers exploring a country for leisure, such as vacationing in Paris or backpacking through Thailand. It’s not designed for those intending to work, even remotely. Engaging in any income-generating activity, like answering work emails or coding for a foreign client, is often a violation of tourist visa terms, though enforcement varies.

In contrast, a Digital Nomad Visa is explicitly crafted for remote workers who want to live in a country while continuing their professional activities. Countries offering these visas, such as Portugal, Costa Rica, and Estonia, aim to attract skilled professionals who contribute to the local economy without competing for local jobs. These visas provide legal permission to work remotely, offering peace of mind and compliance with local laws.

2. Duration of Stay

- Tourist Visa: Most tourist visas allow stays of 30–90 days, with some countries offering visa-free entry for similar periods (e.g., Schengen Area countries for U.S. citizens). Extensions are possible in some cases, but frequent renewals or “visa runs” (leaving and re-entering to reset the stay period) can attract scrutiny from immigration authorities.

- Digital Nomad Visa: These visas cater to longer stays, typically ranging from 6 months to 2 years, with options for renewal in many cases. For example, Estonia’s Digital Nomad Visa allows a 12-month stay, while Costa Rica’s offers up to 2 years with potential extensions. This makes digital nomad visas ideal for those seeking to immerse themselves in a new culture while maintaining their careers.

3. Work Legality

One of the most critical differences is the ability to work legally:

- Tourist Visa: Working on a tourist visa, even remotely, is generally illegal. For instance, in the U.S., the B1/B2 visa allows short-term business activities like attending conferences but prohibits ongoing remote work. Violating these terms can lead to fines, deportation, or bans from re-entering the country. However, enforcement is often lax, especially for discreet remote work, creating a legal gray area that many digital nomads exploit.

- Digital Nomad Visa: These visas explicitly permit remote work for foreign employers or clients. For example, Italy’s Digital Nomad Visa requires proof of employment or self-employment outside Italy, ensuring you’re not taking local jobs. This legal clarity eliminates the risk of immigration issues and provides a stable framework for long-term stays.

4. Taxation Implications

- Tourist Visa: Since tourist visas prohibit work, there’s typically no obligation to pay local taxes. However, staying beyond a certain period (often 183 days) may trigger tax residency, requiring you to file taxes in the host country. This can complicate matters if you’re working illegally on a tourist visa.

- Digital Nomad Visa: Taxation varies by country. Some, like Portugal, offer tax exemptions or benefits for digital nomads under certain conditions (e.g., the Non-Habitual Resident program). Others may require contributions to local taxes if you stay long enough to become a tax resident. Double taxation agreements between countries can prevent paying taxes twice, but you’ll need to consult a tax professional to navigate these complexities.

5. Cost and Application Process

- Tourist Visa: These are typically affordable, with fees ranging from free (e.g., visa-free entry to Japan for U.S. citizens) to $100. The application process is straightforward, often requiring only a passport, proof of funds, and a return ticket. Some countries, like Thailand, offer visa-on-arrival options.

- Digital Nomad Visa: Costs vary significantly. For example, Estonia’s visa fee is around $100–$120, while Barbados charges up to $2,000 for its Welcome Stamp. The application process is more involved, requiring documents like:

- Proof of income (e.g., $50,000 annually for Barbados).

- Proof of remote work (e.g., employment contract or client invoices).

- Health insurance.

- Background checks (in some cases).

Processing times can range from weeks to months, so planning ahead is essential.

6. Family Inclusion

- Tourist Visa: These visas typically don’t allow family members to join, as they’re designed for individual travelers. If family members wish to accompany you, they must apply for their own tourist visas.

- Digital Nomad Visa: Many programs, such as those in Spain and Costa Rica, allow spouses and children to join, provided additional documentation (e.g., marriage certificates, proof of financial support) is submitted. This makes digital nomad visas more family-friendly for those relocating long-term.

7. Access to Local Services

- Tourist Visa: Access to local services like healthcare, banking, or long-term rentals is limited. Tourists often rely on travel insurance and foreign bank accounts, which can be inconvenient for extended stays.

- Digital Nomad Visa: These visas often grant access to local services, such as opening bank accounts, leasing apartments, or enrolling in healthcare systems. For example, Portugal’s D7 visa (used by some digital nomads) allows access to the national health service.

Pros and Cons

Tourist Visa

Pros:

- Simple and quick application process.

- Low or no cost.

- Ideal for short, flexible travel without work commitments.

Cons:

- Limited stay duration (30–90 days).

- Prohibits work, creating legal risks for remote workers.

- Minimal access to local services.

Digital Nomad Visa

Pros:

- Legal permission to work remotely.

- Longer stays (6–24 months) with renewal options.

- Access to local services and potential tax benefits.

Cons:

- Higher costs and more complex applications.

- Potential local tax obligations.

- Varying requirements across countries.

Popular Countries Offering Digital Nomad Visas

Several countries have embraced the digital nomad trend, offering tailored visa programs. Below is a table summarizing key programs, including requirements and costs:

| Country | Visa Name | Duration | Minimum Income | Cost | Family Inclusion |

|---|---|---|---|---|---|

| Estonia | Digital Nomad Visa | 12 months | €3,504/month | €80–€100 | Yes |

| Portugal | D7 Visa (used for nomads) | 12 months, renewable | €760/month | €170–€400 | Yes |

| Costa Rica | Rentista (Digital Nomad) | 24 months, renewable | $2,500/month | $250–$1,000 | Yes |

| Barbados | Welcome Stamp | 12 months | $50,000/year | $2,000 (individual) | Yes |

| Italy | Digital Nomad Visa | 12 months | €28,000/year | €200–€500 | Yes |

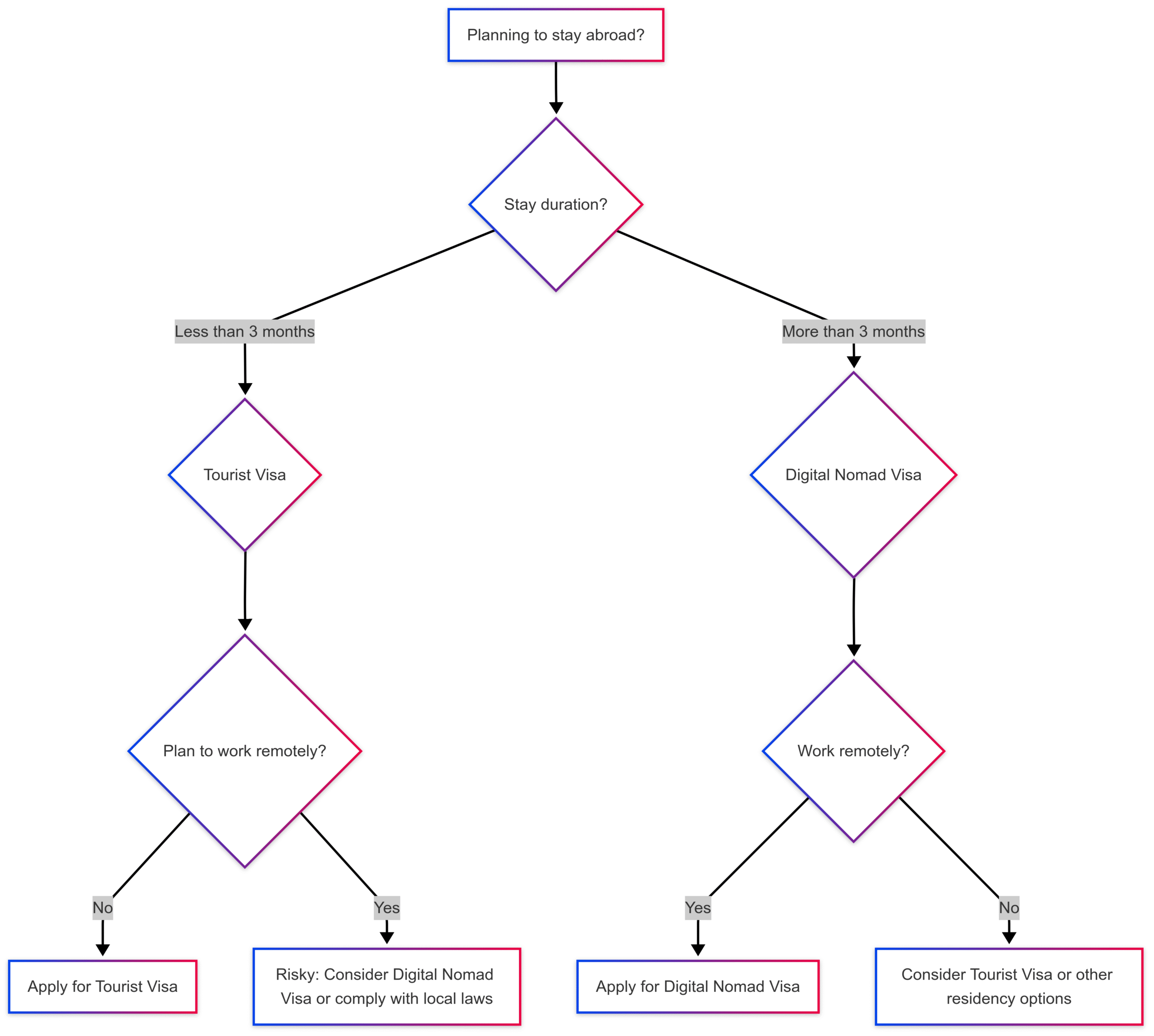

Chart: Visa Decision Flow

To help visualize the decision-making process, here’s a flowchart:

This chart helps you decide based on your stay duration and work intentions.

The Legal Gray Area of Working on a Tourist Visa

Many digital nomads work remotely on tourist visas, despite the legal risks. Online discussions reveal a common sentiment: enforcement is rare unless you’re working for local clients or overstaying your visa. For example, a user on a social platform noted, “It’s illegal in most countries, but unless you announce it at immigration, it’s unlikely anyone will find out you’re working online.” Another commented, “I’ve been doing this for years—customs doesn’t care what you do on your laptop as long as you’re not taking local jobs.”

However, the risks are real. In the U.S., for instance, working on a B2 visa can lead to deportation or bans, especially if immigration officers suspect prolonged work. A user shared a story of a traveler interrogated for hours after admitting to remote work at U.S. customs. Similarly, countries like Thailand and Bali have cracked down on nomads working illegally, particularly those running local businesses.

The legal gray area stems from outdated laws not yet adapted to remote work. Some countries, like Japan, allow “business activities” (e.g., attending meetings) on visa-free entries but draw a line at ongoing remote work. To avoid issues, many nomads adopt a “don’t ask, don’t tell” approach, declaring tourism as their purpose at immigration.

Tax Considerations for Digital Nomads

Taxation is a critical factor. On a Tourist Visa, you’re unlikely to face local tax obligations unless you stay long enough to trigger tax residency (typically 183 days). However, working illegally could complicate matters if discovered.

With a Digital Nomad Visa, tax rules vary. Some countries, like Barbados, offer tax exemptions for nomads, while others, like Portugal, may require tax filings after a certain period. Double taxation agreements can prevent paying taxes in both your home and host countries, but you’ll need to maintain tax residency somewhere. A user emphasized, “You have to pay taxes somewhere, or your home country can back-claim you later.”

Consulting a tax professional is crucial to navigate these complexities, especially if you’re hopping between countries.

Choosing the Right Visa for You

Your choice depends on your goals:

- Short-Term Travelers: If you’re staying less than 90 days and not working, a tourist visa is sufficient. It’s low-cost, easy to obtain, and flexible for quick trips.

- Digital Nomads: If you plan to work remotely for 6 months or more, a digital nomad visa is the safer, legal option. It offers stability, access to services, and peace of mind.

Consider your lifestyle:

- Fast-Paced Nomads: Moving every 3 months? Tourist visas or visa-free entries might work, but you’re in a legal gray area if working.

- Slow Nomads: Settling in one place for a year? A digital nomad visa is essential for legality and integration.

Real-World Examples

- Chiang Mai, Thailand: A hub for digital nomads, many stay on tourist visas or visa runs, working remotely without issues. Thailand’s new Long-Term Resident Visa (LTR) now offers a legal path for nomads, with a 10-year stay option for high earners.

- Portugal: The D7 visa is popular for its low income requirement (€760/month) and access to the Schengen Area, making it ideal for nomads seeking a European base.

- Colombia: Its Digital Nomad Visa is lenient, requiring only proof of foreign income and legal entry, attracting nomads already in the country.

Final Thoughts

The choice between a Digital Nomad Visa and a Tourist Visa hinges on your travel duration, work intentions, and desire for legal compliance. Tourist visas suit short, leisure-focused trips but are risky for remote work. Digital nomad visas, while more complex to obtain, offer a legal, stable framework for living and working abroad, with access to local services and potential tax benefits.

As remote work grows, more countries are launching digital nomad visa programs, signaling a shift toward embracing location-independent professionals. Before applying, research your destination’s specific requirements and consult professionals for tax and legal advice. With the right visa, you can focus on your adventure—whether it’s coding from a beach in Bali or designing from a café in Lisbon—without worrying about immigration surprises.

Please share this Digital Nomad Visa vs Tourist Visa: key differences with your friends and do a comment below about your feedback.

We will meet you on next article.

Until you can read, Uruguay Digital Nomad Visa: The Ultimate Guide