Discover Estonia’s Digital Nomad Visa: eligibility, application process, costs, and tips for remote workers to live in Europe’s digital hub for up to a year.

Estonia, a small Baltic nation with a global reputation for digital innovation, has become a beacon for remote workers seeking a seamless blend of modern infrastructure, rich culture, and natural beauty. The Estonia Digital Nomad Visa (DNV), launched in 2020, was the world’s first of its kind, offering remote workers, freelancers, and entrepreneurs the chance to live legally in Estonia for up to one year while working for foreign employers or clients. Coupled with its pioneering e-Residency program, Estonia provides a unique ecosystem for location-independent professionals. This comprehensive guide explores the Digital Nomad Visa, compares it with e-Residency, outlines eligibility criteria, details the application process, and highlights why Estonia is a top destination for digital nomads.

Introduction: Why Choose Estonia for Your Digital Nomad Journey?

Estonia, often dubbed the “digital nation,” has transformed how countries cater to global professionals. With a population of just over 1.3 million and a capital city, Tallinn, that blends medieval charm with cutting-edge technology, Estonia offers an ideal environment for digital nomads. The country ranks 39th on the VisaGuide Digital Nomad Index with a score of 2.07, boasting an average internet speed of 89.13 Mbps, a flat tax rate of 20%, and monthly living costs around €850. Its Digital Nomad Visa addresses the legal ambiguities remote workers face when working abroad on tourist visas, providing a clear path to live and work legally.

This article dives into the specifics of the Digital Nomad Visa, contrasts it with the e-Residency program, and provides actionable steps for applying. Whether you’re a freelancer, a remote employee, or an entrepreneur, Estonia’s forward-thinking policies make it a prime destination for your next adventure.

Understanding the Estonia Digital Nomad Visa

The Estonia Digital Nomad Visa is a residence permit designed for remote workers who operate independently of location. It allows holders to live in Estonia for up to 12 months while working for a foreign employer, running a business registered abroad, or freelancing for clients primarily outside Estonia. Unlike traditional work visas, the DNV does not require a local employer, making it perfect for digital nomads who value flexibility.

Key Features of the Digital Nomad Visa

- Duration: Up to 12 months (Type D) or 90 days (Type C).

- Schengen Access: Visa holders can travel visa-free within the Schengen Area for up to 90 days within a 180-day period.

- Tax Implications: If you stay in Estonia for more than 183 days in a year, you become a tax resident, subject to a flat 20% income tax on worldwide income.

- Family Inclusion: Dependents can join, provided they meet visa requirements and submit necessary documentation.

Who Is It For?

The visa targets three main groups:

- Remote Employees: Individuals with employment contracts from companies registered outside Estonia.

- Freelancers: Professionals offering services to clients primarily based outside Estonia.

- Entrepreneurs: Business owners with companies registered abroad.

e-Residency vs. Digital Nomad Visa: What’s the Difference?

Estonia’s e-Residency program and Digital Nomad Visa cater to overlapping but distinct audiences. Understanding their differences is crucial for choosing the right path.

| Feature | e-Residency | Digital Nomad Visa |

|---|---|---|

| Purpose | Provides a digital identity to establish and manage a business in Estonia remotely | Allows remote workers to live and work legally in Estonia for up to one year |

| Target Audience | Entrepreneurs and business owners | Remote workers, freelancers, and entrepreneurs |

| Physical Presence | Does not permit living in Estonia | Permits living in Estonia for up to 12 months |

| Application Process | Online at e-resident.gov.ee, takes 3-8 weeks | In-person at Estonian embassies, consulates, or VFS Global, takes 15-30 days |

| Key Benefits | Access to Estonia’s e-services, EU market, and favorable tax system | Legal right to live and work remotely in Estonia, Schengen Area travel |

| Cost | €100-€120 (depending on pickup location) | €80 (Type C), €100 (Type D) |

e-Residency: A Digital Gateway for Entrepreneurs

Launched in 2014, the e-Residency program grants a government-issued digital identity, enabling entrepreneurs to start and manage an EU-based company online. It provides access to Estonia’s e-services, such as digital banking, tax declaration, and business registration, without requiring physical presence. This program is ideal for those who want to leverage Estonia’s business-friendly environment without relocating.

Digital Nomad Visa: A Home for Remote Workers

Introduced in 2020, the Digital Nomad Visa is tailored for remote workers who wish to live in Estonia while maintaining employment or business activities abroad. It addresses the needs of digital nomads who previously faced legal uncertainties when working on tourist visas. The visa allows you to immerse yourself in Estonia’s high-quality lifestyle while continuing your remote work.

Eligibility Criteria for the Digital Nomad Visa

To qualify for the Estonia Digital Nomad Visa, applicants must meet the following requirements:

- Remote Work Capability: You must perform your job using telecommunications technology, allowing location-independent work.

- Employment or Business Status:

- Employed by a company registered outside Estonia.

- Operating a business registered abroad.

- Freelancing for clients primarily outside Estonia.

- Minimum Income: A gross monthly income of at least €4,500 for the six months prior to application (subject to change; verify current threshold).

- Clean Criminal Record: No serious criminal convictions.

- Health Insurance: Valid coverage for the Schengen Area with a minimum of €30,000.

- Valid Passport: Must be valid for at least three months beyond your planned stay, with two blank pages.

- Proof of Accommodation: A rental agreement, hotel booking, or invitation letter confirming your place of stay in Estonia.

Note: The income threshold has varied in official sources (e.g., €3,504 to €4,500). Always check the latest requirements on the Estonian Police and Border Guard Board or Ministry of Foreign Affairs websites.

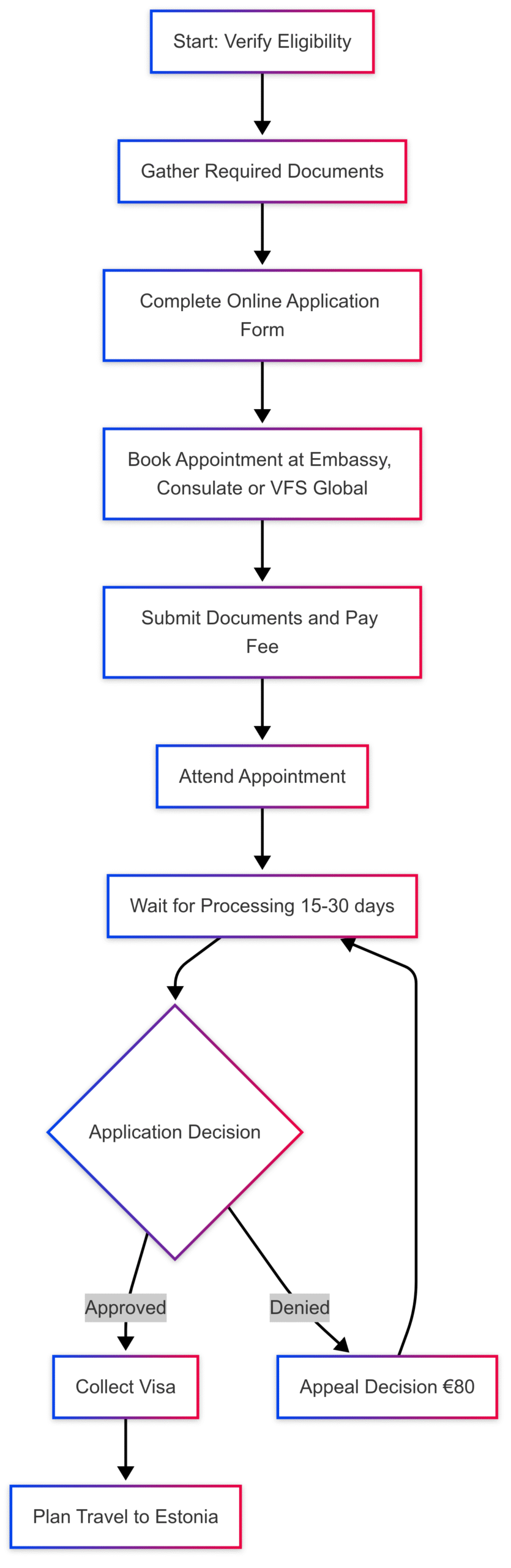

How to Apply for the Estonia Digital Nomad Visa

The application process is straightforward but requires meticulous preparation. Below is a step-by-step guide to securing your visa.

Step 1: Verify Eligibility

Ensure you meet the eligibility criteria outlined above. Confirm your income, employment status, and ability to work remotely.

Step 2: Gather Required Documents

Prepare the following documents:

- Valid Passport: With at least three months of validity beyond your stay and two blank pages.

- Completed Application Form: Available on the Estonian Ministry of Foreign Affairs website or e-Residency portal.

- Proof of Remote Work: Employment contract, business registration documents, or freelance contracts.

- Bank Statements: Showing a minimum monthly income of €4,500 for the past six months.

- Health Insurance: Coverage of at least €30,000 for the Schengen Area.

- Criminal Record Certificate: Issued by your home country’s authorities.

- Proof of Accommodation: Rental agreement, hotel booking, or invitation letter.

- Educational Certificates: Optional but recommended (e.g., university degree).

- Cover Letter: Explaining your intent to work remotely in Estonia.

- Employer Letter: Confirming your ability to work remotely.

- Tax Compliance Documents: Proof of paid state and local taxes in your home country.

- Two Passport Photos: Meeting Schengen visa photo requirements.

Documents must be in English, Estonian, or Russian. Translations may be required for other languages.

Step 3: Submit Your Application

Applications can be submitted through one of three channels:

- Estonian Embassy or Consulate: Book an appointment at the nearest embassy or consulate. Some locations allow drop-ins, but appointments are recommended.

- VFS Global Visa Application Centers: Available in countries like the USA (Washington DC, New York, Chicago, Houston, San Francisco, Los Angeles), Canada, Australia, Japan, and Ukraine.

- Police and Border Guard Board (PBGB): If you’re already legally in Estonia, apply at a PBGB office.

Note: Applications cannot be submitted in Russia (Moscow, Saint Petersburg, Pskov) or Belarus due to current restrictions.

Step 4: Pay the Application Fee

- Type C Visa (Short-Stay, up to 90 days): €80

- Type D Visa (Long-Stay, up to 12 months): €100

Payments are made during the application submission. Keep the receipt as proof of payment.

Step 5: Attend Your Appointment

Bring all documents to your appointment. Be prepared to answer questions about your work, income, and plans in Estonia. The visa officer will verify your documents and identity.

Step 6: Await Processing

Applications are typically processed within 15-30 days. You’ll be notified via email or phone of the decision. If approved, collect your visa at the embassy, consulate, or VFS Global center. If denied, you can appeal for an additional €80 fee.

Step 7: Plan Your Move

Once approved, book your travel and accommodations. Notify your bank of your travel plans to avoid issues with international transactions. Connect with digital nomad communities in Estonia for local insights.

Application Process Flowchart

Below is a visual representation of the application process using syntax:

Living Costs in Estonia for Digital Nomads

Estonia offers a relatively affordable cost of living compared to other European countries, making it attractive for digital nomads. Below is a breakdown of typical monthly expenses:

| Category | Cost Range (€) |

|---|---|

| 1-Bedroom Apartment (City Center) | €400–€800 |

| 1-Bedroom Apartment (Outside Center) | €300–€600 |

| 3-Bedroom Apartment (City Center) | €750–€1,700 |

| 3-Bedroom Apartment (Outside Center) | €500–€1,100 |

| Utilities (85m² Apartment) | €185–€425 |

| Groceries (Selected Items) | |

| – Milk (1L) | €1.05 |

| – Rice (1kg) | €2.06 |

| – Eggs (12) | €2.49 |

| – Apples (1kg) | €1.67 |

| – Bananas (1kg) | €1.28 |

| – Tomatoes (1kg) | €2.49 |

| – Potatoes (1kg) | €0.87 |

| Local Transport (Single Ride) | €1.00–€2.00 |

| Taxi (1km) | €0.57–€1.30 |

| Gasoline (1L) | €1.62–€1.90 |

Total Estimated Monthly Cost: Approximately €1,000, depending on lifestyle and location.

Best Places for Digital Nomads in Estonia

Estonia offers diverse locales catering to different preferences, from vibrant cities to serene coastal towns. Here are the top destinations:

- Tallinn: The capital city combines medieval charm with a thriving tech scene. Its Old Town, a UNESCO World Heritage Site, offers cobblestone streets and historic sites, while coworking spaces and high-speed Wi-Fi cater to digital nomads. Tallinn is ideal for those seeking cultural immersion and networking opportunities.

- Tartu: A youthful university town known for its intellectual vibe, Tartu is home to Estonia’s oldest university and numerous museums. It’s more affordable than Tallinn and perfect for those seeking a quieter, creative environment.

- Pärnu: A coastal gem with sandy beaches and a relaxed vibe, Pärnu is ideal for nomads who love seaside living. Its vibrant arts and music scene adds to its appeal.

- Haapsalu: A tranquil coastal town with a romantic atmosphere, perfect for those seeking peace and inspiration.

- Lahemaa National Park: For nature lovers, this area offers forests, bogs, and coastlines, ideal for remote work in a serene setting.

Tax Implications for Digital Nomads

If you stay in Estonia for more than 183 days in a year, you become a tax resident, liable for a flat 20% income tax on your worldwide income. Estonia’s tax system is straightforward, and the country has a double taxation treaty with the United States, which may help avoid double taxation for U.S. citizens. However, due to the U.S. Savings Clause, most treaty benefits are limited.

U.S. Expat Tax Considerations

U.S. citizens must file federal tax returns regardless of residence, but the following provisions may reduce tax liability:

- Foreign Earned Income Exclusion (FEIE): Exclude up to $120,000 (2023) of foreign-earned income if you pass the Physical Presence Test or Bona Fide Residence Test.

- Foreign Tax Credit (FTC): Offset U.S. tax liability with taxes paid to Estonia.

- Foreign Housing Exclusion/Deduction: Deduct qualifying housing expenses like rent and utilities.

- Foreign Bank Account Report (FBAR): Report foreign bank accounts with a total balance of $10,000 or more.

- FATCA: File Form 8938 if foreign assets exceed $200,000 (last day of the year) or $300,000 (any point during the year).

Consult a tax professional specializing in expat taxes to optimize your strategy. For tax-related inquiries, contact the Estonian Tax and Customs Board at nonresident@emta.ee.

Frequently Asked Questions

Is there a limit on the number of Digital Nomad Visas issued?

No, Estonia does not impose a cap on the number of visas issued.

What is the processing time?

Applications are typically processed within 15-30 days.

Can I become an Estonian citizen with this visa?

No, the Digital Nomad Visa is temporary and does not lead to permanent residency or citizenship.

Can I travel to other Schengen countries?

Yes, you can travel visa-free within the Schengen Area for up to 90 days in a 180-day period.

Can I bring family members?

Yes, dependents can apply for their own visas with appropriate documentation.

Can I apply while in Estonia?

Yes, if you’re legally in Estonia, you can apply at a Police and Border Guard Board office.

Why Estonia Stands Out for Digital Nomads

Estonia’s Digital Nomad Visa is a game-changer for remote workers, offering legal clarity, access to a digitally advanced nation, and the freedom to explore the Schengen Area. With its high-speed internet, affordable living costs, and vibrant startup ecosystem, Estonia is more than just a destination—it’s a lifestyle upgrade. From Tallinn’s historic charm to Pärnu’s seaside tranquility, there’s a place for every nomad to thrive.

Official Resources

- Estonian Police and Border Guard Board: https://www.politsei.ee/en

- Ministry of Foreign Affairs: https://vm.ee/en/visa-information

- e-Residency Portal: https://www.e-resident.gov.ee/

- VFS Global: https://www.vfsglobal.com/

Conclusion

Estonia’s Digital Nomad Visa opens the door to a unique blend of digital innovation, cultural richness, and natural beauty. By meeting the eligibility criteria, preparing the necessary documents, and following the application process, you can embark on a transformative journey in one of Europe’s most forward-thinking nations. Whether you’re drawn to Tallinn’s bustling tech scene or the serene landscapes of Lahemaa, Estonia offers a welcoming home for digital nomads. Start your application today and experience the freedom of remote work in a country that’s redefining the future of work.

Please share this Estonia Digital Nomad Visa – Eligibility and Application with your friends and do a comment below about your feedback.

We will meet you on next article.

Until you can read, Ecuador Digital Nomad Visa – Rentista Visa Requirements