Master work and finances as a digital nomad with expert tips on budgeting, time management, and setting up a U.S. LLC for success.

The digital nomad lifestyle offers unparalleled freedom to work from anywhere while exploring new cultures and environments. However, this freedom comes with unique challenges, particularly in managing work and finances effectively. From creating a sustainable budget to maintaining productivity across time zones, digital nomads must adopt strategic practices to thrive. This comprehensive guide provides actionable tips for balancing work, finances, and lifestyle, including insights on forming a U.S. company or LLC to streamline operations and protect assets. Whether you’re a seasoned nomad or just starting, these strategies will help you navigate the complexities of this lifestyle with confidence.

Understanding the Digital Nomad Lifestyle

Digital nomads leverage technology to work remotely while traveling the world. They prioritize flexibility, often choosing destinations with lower costs of living, vibrant communities, or desirable climates. Common professions include freelancing, online teaching, software development, content creation, and e-commerce. The lifestyle appeals to those who value independence over traditional office-based work, but it demands discipline to manage fluctuating incomes, tax obligations, and work-life balance. Below, we explore key areas to master this lifestyle, supported by practical tools, charts, and strategies.

Time Management and Work-Life Balance

Maintaining productivity while traveling requires a structured approach to time management and clear boundaries between work and leisure. Here are proven strategies to stay focused and healthy.

Establishing a Routine

A consistent routine anchors productivity, even in dynamic environments. Consider these steps:

- Plan Your Workday: Create a daily to-do list using tools like Trello or Asana. Prioritize tasks based on urgency and impact. For example, tackle high-priority tasks like client deliverables first.

- Identify Peak Productivity Times: Determine when you’re most focused (e.g., mornings or evenings) and schedule complex tasks during these periods.

- Create a Dedicated Workspace: Whether it’s a coworking space or a quiet café, a consistent work environment minimizes distractions. Invest in noise-canceling headphones (e.g., Sony WH-1000XM5, ~$400) for added focus.

- Build in Flexibility: Allow room for unexpected changes, such as flight delays or local holidays, to adapt without stress.

Setting Clear Boundaries

Separating work and leisure prevents burnout and enhances well-being:

- Define Work Hours: Set specific hours (e.g., 9 AM–5 PM) and communicate them to clients via email signatures or project management tools.

- Take Regular Breaks: Use the Pomodoro Technique (25 minutes work, 5 minutes break) to maintain energy. Apps like Focus@Will (~$69/year) can enhance focus during work sessions.

- Disconnect After Hours: Turn off work notifications after hours using tools like Slack’s “Do Not Disturb” mode.

- Reserve Weekends: Avoid work on weekends to recharge. Schedule leisure activities like hiking or cultural tours to immerse yourself in your destination.

Utilizing Productivity Tools

Technology can streamline workflows and boost efficiency. Popular tools include:

- Toggl Track (~$10/month): Tracks time spent on tasks to identify productivity patterns.

- Asana (~$10.99/month): Organizes projects and deadlines, ideal for collaborating with remote teams.

- Notion (~$8/month): Combines note-taking, task management, and scheduling in one platform.

Prioritizing Self-Care

Self-care is critical to avoid burnout in a lifestyle that blends work and travel:

- Exercise Regularly: Incorporate 30-minute workouts, such as yoga or running, to boost energy. Apps like Nike Training Club (free) offer guided workouts.

- Practice Mindfulness: Use apps like Headspace (~$69.99/year) for meditation to reduce stress.

- Stay Connected: Combat isolation by joining digital nomad communities on platforms like Nomad List (~$99/year) or local meetups via Meetup.com.

- Take Breaks: Step away from screens every 90 minutes to stretch or walk, improving focus and reducing eye strain.

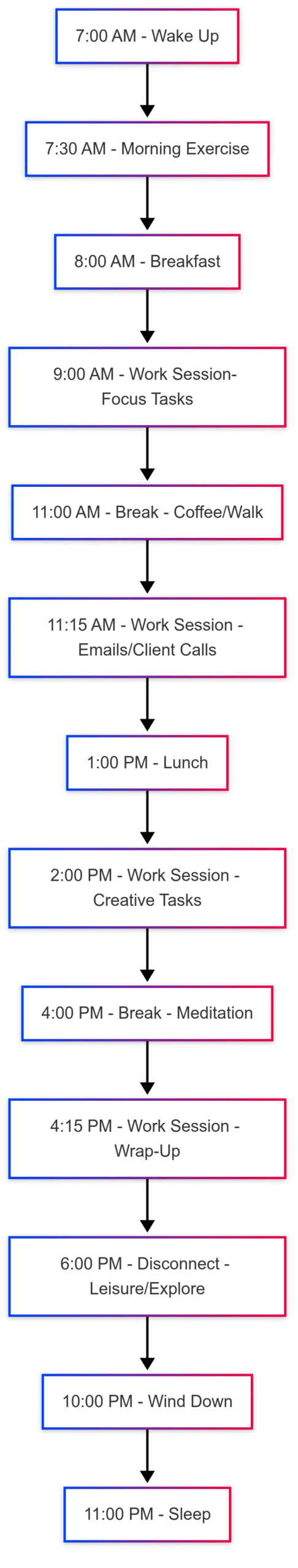

Chart: Sample Daily Routine for a Digital Nomad

This routine balances work, breaks, and personal time, adaptable to different time zones.

Budgeting and Financial Planning

Financial stability is the backbone of a sustainable digital nomad lifestyle. Effective budgeting, expense tracking, and planning for taxes and emergencies are essential.

Creating a Realistic Budget

A well-structured budget accounts for variable incomes and travel costs. The 50/30/20 rule is a practical framework:

- 50% Essentials: Housing, utilities, food, transportation.

- 30% Discretionary: Leisure, travel, dining out.

- 20% Savings: Emergency fund, retirement, investments.

Table: Sample Monthly Budget for a Digital Nomad

| Category | Amount (USD) | Notes |

|---|---|---|

| Housing (Airbnb/Co-living) | 800 | Shared space in Chiang Mai, Thailand |

| Utilities (WiFi, Phone) | 50 | Local SIM + high-speed internet |

| Food (Groceries/Dining) | 300 | Mix of cooking and local eateries |

| Transportation | 100 | Scooter rental + public transport |

| Insurance (Health/Travel) | 100 | Comprehensive nomad insurance |

| Work Expenses (Tools) | 50 | Software subscriptions (e.g., Adobe) |

| Leisure/Travel | 300 | Weekend trips, cultural activities |

| Savings/Emergency Fund | 300 | High-yield savings account |

| Total | 2,000 | Based on $3,000 monthly income |

Tracking Income and Expenses

Regular tracking ensures you stay within budget:

- Use Budgeting Apps: Mint (free) syncs bank accounts to track spending, while YNAB (~$99/year) helps plan for irregular incomes.

- Record All Transactions: Save receipts digitally using apps like Expensify (~$9/month) for business expenses.

- Monthly Check-Ins: Review spending patterns to adjust for high-cost destinations or unexpected expenses.

Setting Aside Money for Taxes and Emergencies

- Taxes: Estimate tax liability based on your home country and destinations. For example, U.S. nomads may owe federal taxes, while EU nomads face varying VAT rules. Set aside 20–30% of income monthly in a separate account.

- Emergency Fund: Aim for 3–6 months of expenses ($6,000–$12,000 for the above budget). Use high-yield savings accounts like Ally Bank (~4% APY).

- Insurance: Invest in comprehensive plans like SafetyWing (~$45/month for health/travel) or World Nomads (~$60/month) to cover medical emergencies and equipment.

Exploring Investment Options

Building wealth ensures long-term stability:

- Retirement Accounts: U.S. nomads can contribute to a Solo 401(k) or IRA (up to $7,000/year for IRAs in 2025). Non-U.S. nomads should explore local equivalents, like SIPPs in the UK.

- High-Yield Savings: Accounts like Marcus by Goldman Sachs (~4.5% APY) offer low-risk growth.

- Investments: Diversify with low-cost ETFs (e.g., Vanguard VTI, ~0.03% expense ratio) or real estate crowdfunding platforms like Fundrise (~$10 minimum).

Cost-Effective Travel Strategies

Choosing affordable destinations and travel methods stretches your budget further.

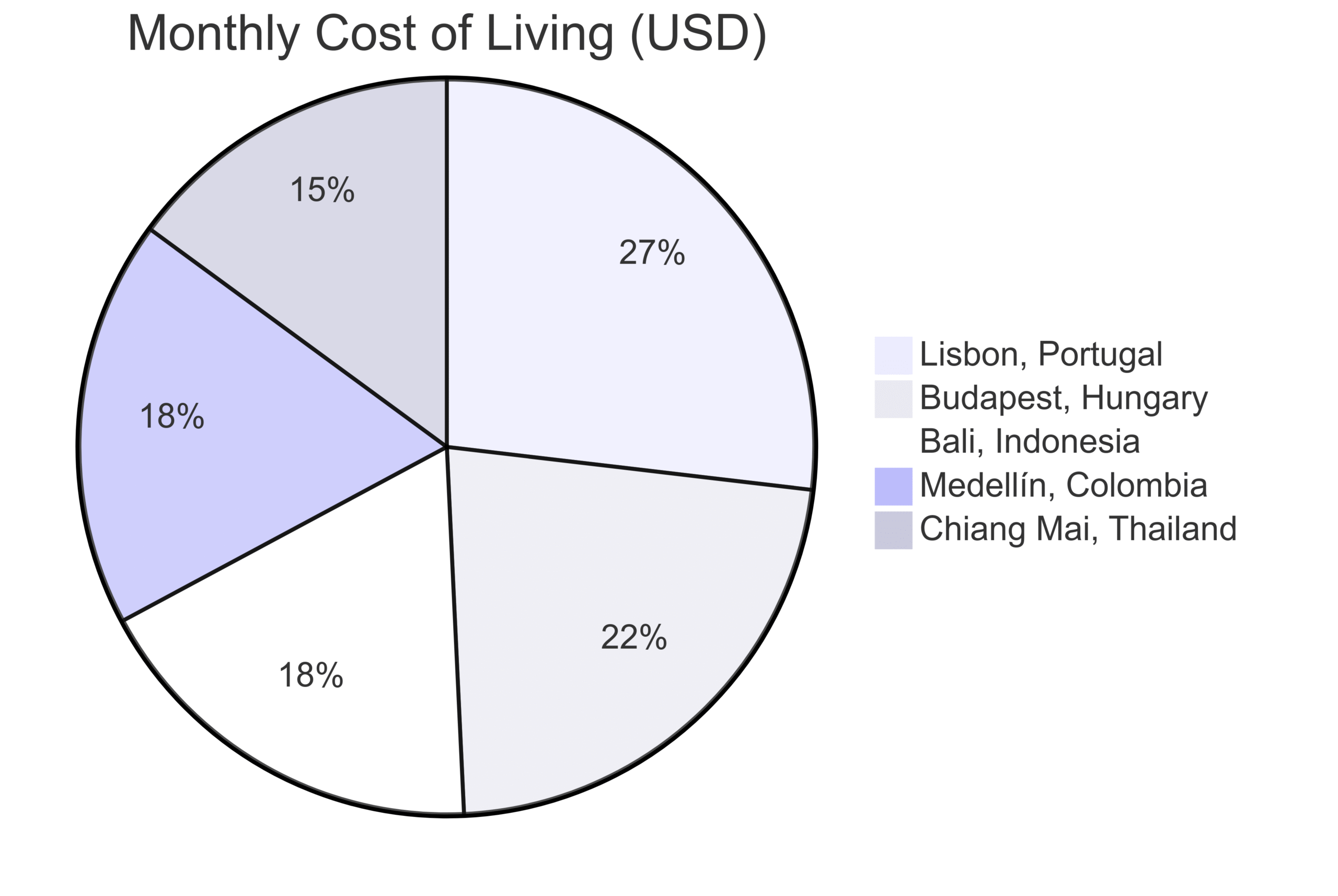

Selecting Budget-Friendly Destinations

Focus on regions with low living costs, reliable internet, and nomad communities:

- Southeast Asia: Chiang Mai, Thailand (~$1,000/month) or Bali, Indonesia (~$1,200/month).

- South America: Medellín, Colombia (~$1,200/month) or Quito, Ecuador (~$1,000/month).

- Eastern Europe: Lisbon, Portugal (~$1,800/month) or Budapest, Hungary (~$1,500/month).

Use tools like Numbeo or Nomad List to compare costs. For example, Chiang Mai’s average rent for a one-bedroom apartment is ~$400/month, compared to ~$2,000 in New York City.

Affordable Travel Tips

- Slow Travel: Stay in one location for 1–3 months to reduce transportation costs. For example, a round-trip flight from Bangkok to Bali costs ~$150, but staying longer saves on frequent flights.

- Co-Living Spaces: Options like Roam (~$500/week) provide housing, workspaces, and community.

- Local Transportation: Use apps like Grab (~$2–$5/ride in Southeast Asia) or public buses (~$0.50/ride) instead of taxis.

Chart: Cost Comparison of Popular Nomad Destinations

Diversifying Income Streams

Relying on a single income source is risky for nomads. Diversification provides stability:

- Freelancing: Platforms like Upwork or Fiverr offer opportunities in writing, design, or coding. Average hourly rates range from $20–$100.

- Online Teaching: Sites like VIPKid pay ~$15–$22/hour for teaching English.

- E-Commerce: Start a dropshipping store using Shopify (~$29/month) or sell digital products like eBooks.

- Passive Income: Create online courses (e.g., Udemy) or invest in dividend stocks (~2–4% yield).

Forming a U.S. Company or LLC

A U.S.-based LLC offers legal and financial benefits for digital nomads, even non-residents.

Benefits of an LLC

- Asset Projection: Separates personal and business liabilities, protecting personal savings from business debts.

- Tax Advantages: Non-U.S. residents may benefit from pass-through taxation, avoiding double taxation. Consult a tax professional to confirm eligibility.

- Simplified Finances: A dedicated business bank account (e.g., Mercury, free) streamlines expense tracking.

Steps to Form an LLC

- Choose a State: Delaware or Wyoming are popular for low fees (~$100–$200) and privacy.

- Register the Business: File Articles of Organization with the state (~$50–$200). Use services like Northwest Registered Agent (~$39 + state fees).

- Obtain an EIN: Apply for free via the IRS website for tax purposes.

- Open a Business Bank Account: Banks like Chase or Mercury offer low-fee accounts for LLCs.

- Maintain Compliance: File annual reports (~$50/year) and track expenses for tax deductions.

Table: Comparison of Business Structures

| Structure | Asset Protection | Tax Complexity | Setup Cost (USD) |

|---|---|---|---|

| Sole Proprietorship | None | Low | ~$0 |

| Partnership | Limited | Medium | ~$100 |

| LLC | High | Medium | ~$100–$500 |

| Corporation | High | High | ~$500–$1,000 |

Seeking Professional Guidance

Consult a CPA or platforms like Xolo (~$49/month for business management) to navigate tax treaties and compliance, especially for non-U.S. residents.

Managing Taxes and Compliance

Tax obligations vary by country and residency status:

- Determine Tax Residency: Spending 183+ days in a country often triggers tax residency. Check treaties to avoid double taxation (e.g., U.S.–UK tax treaty).

- Set Aside Tax Funds: Save 20–30% of income in a separate account. Use tools like QuickBooks (~$25/month) for tax tracking.

- Leverage Deductions: Claim business expenses like software subscriptions, travel, or coworking fees.

- Professional Support: Services like Deel (~$49/month) offer localized tax advice for nomads.

Insurance for Digital Nomads

Comprehensive insurance mitigates risks:

- Health/Travel Insurance: SafetyWing (~$45/month) covers medical emergencies and trip cancellations.

- Equipment Insurance: Insure laptops or cameras (~$10–$20/month) against theft or damage.

- Business Insurance: General liability (~$30/month) protects against client disputes.

Banking and Currency Management

Minimize fees with strategic banking:

- Global Banks: HSBC Expat or Wise (~$0–$2/transfer) offer multi-currency accounts with low fees.

- Digital Wallets: Revolut (~$0–$7/month) supports 30+ currencies with competitive exchange rates.

- Local Accounts: Open accounts in long-term destinations for lower transaction costs.

Conclusion

The digital nomad lifestyle blends freedom with responsibility. By establishing routines, setting boundaries, and leveraging productivity tools, you can maintain work-life balance. Strategic budgeting, diversified income, and a U.S. LLC provide financial stability. With careful planning—using tools like budgeting apps, tax services, and insurance—you can navigate global challenges and focus on the rewards of working from anywhere. Embrace these strategies to build a sustainable, fulfilling nomad journey.

Please share this Tips for Managing Work and Finances as a Digital Nomad with your friends and do a comment below about your feedback.

We will meet you on next article.

Until you can read, Tips For Solo Traveller to Explore Russia